Ensure that your pricing structure accounts for transaction volume. Your level of experience and expertise is a significant determinant of your pricing. As a beginner, you may charge less than someone with years of experience. Consider your qualifications, certifications, and the quality of your work when setting your rates. When you hire one of these firms, the usual process is that they’ll give you a quote estimating how many hours it will take them to do your books, and what the cost for that will be.

What is a full charge bookkeeper?

If you use specialized software or tools for bookkeeping, it can affect your pricing. Clients may be willing to pay more for efficient and accurate bookkeeping using advanced software. Engaging with a bookkeeper is an important milestone for young companies. Regardless of the solution you choose, you’ll be taking a big step towards getting your time back, and building a financial foundation to help your business continue to grow. If you want a high degree of control and direct oversight over how your books are done, hiring an in-house bookkeeper might be the way to go.

- Plus, bookkeepers will ensure you’re in compliance with local and federal laws (which can ultimately save you money in the long run).

- When setting your prices, ensure you are charging enough to cover these fees.

- It lets you know how you’re doing with cash flow and how your business is doing overall.

- When bookkeeping tasks become too time-consuming to handle on your own, hiring an online bookkeeping service can be a worthwhile investment.

People found Accounting & Tax Services by searching for…

As you’ve seen, there are several solutions to this bookkeeping dilemma, but they also come with additional questions you should keep in mind before making a decision. To help you on this decision-making journey, we’ve gathered four questions to ask yourself before hiring a bookkeeper. On top of this, it is also a bookkeeper’s job to keep everything organized. That way, when it is time to file your small business taxes, you can easily access all the data you need.

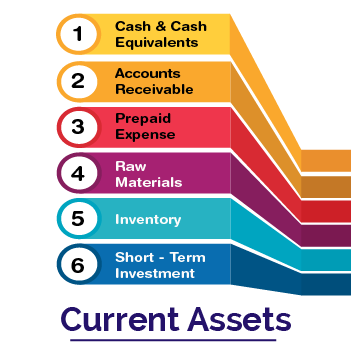

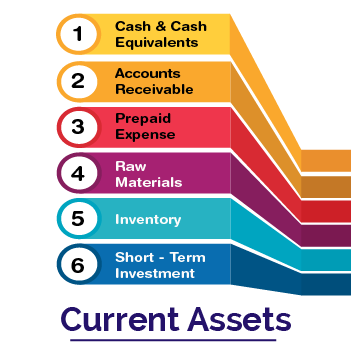

What is the Difference Between Small, Medium, and Large Clients?

As a result, they come with a higher monthly cost for business owners. FreshBooks is an invoicing and accounting software for small businesses. Business owners who wish to automate their financial tasks can use some of the latest tools on the market.

Client size

No waiting for hours on hold—just helpful support from real people. To decide which option is best for you, consider your experience level, the type of work you’ll be doing, and your clients’ needs. net worth: what it is and how to calculate it The costs a small business or nonprofit incurs for bookkeeping will depend upon many variables. It works with Quickbooks or Xero but you’ll need your own subscription to those services.

Client doesn’t have to provide benefits

Keep in mind that this is often not binding – meaning it might take a lot longer than they think it will, which means your costs would be a lot higher than the quote. There are some times that we’ll request documents from you (like account statements or receipts), just to ensure the information we have is correct. If you need to share files with your bookkeeping team, it’s as simple as uploading a file.

Personal FICO credit scores and other credit scores are used to represent the creditworthiness of a person and may be one indicator to the credit or financing type you are eligible for. Nav uses the Vantage 3.0 credit score to determine which credit offers are recommended which may differ from the credit score used by lenders and service providers. However, credit score alone does not guarantee or imply approval for any credit card, financing, or service offer. InDinero focuses on providing startups in the growth stage with accounting services to help them move toward an exit strategy. This service may be helpful in aiding you in considering your startup’s financial options.

Bookkeeper360 puts a team of CPAs, advisors, and technology experts at your fingertips to help you better manage your finances. This bookkeeping solution focuses on startups and growth-stage companies. Terms, conditions, pricing, special features, and service and support options subject to change without notice. If your monthly average is $50,001 or more, the monthly price for QuickBooks Live Expert Full-Service Bookkeeping is $700. If your monthly average is $10,001-50,000, the monthly price for QuickBooks Live Expert Full-Service Bookkeeping is $500.

In the past, it was popular for bookkeepers to charge per transaction. To be honest, I’ve never done it that way, so I’m not as familiar with what the rates would be for this type of pricing. If you’re interested to learn more, Google it, and I’m sure a plethora of information will show up. Many bookkeepers charge their clients for initial consultations because it gives them a chance to look at the books.

Proprietary bookkeeping software could make it difficult to switch to another provider in the future. If you think your bookkeeper has made a mistake, QuickBooks will evaluate the situation and correct errors at no additional cost. To illustrate what a small client looks like, I’ll be using a preschool I do bookkeeping for that generates about $150k in revenue a year. Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development.

Even if you aren’t planning on growing any time soon, you need to have a sense of how much money is coming in versus what is going out. On top of that, you need the data used in bookkeeping to file your taxes accurately. As a business owner, it is important to understand your company’s financial health.

But who wants the task of sifting through receipts and organizing statements when there’s a whole slew of business operations to attend to? It may be time for you to make the executive decision of hiring a bookkeeper to margin vs markup take the reins. Whatever structure and pricing you go with, make sure to lay it all out on the table for current and prospective clients. That way, there are no surprise fees, and clients know what to expect from you.

Bench Accounting is an online bookkeeping service that pairs your business with dedicated in-house bookkeepers to keep your financials accurate and up to date. Each month your bookkeeper will categorize your transactions, reconcile your bank accounts and prepare financial statements on your behalf. In this way, Bench can replace traditional accounting software for many businesses.

The most obvious cost for this option is salary, which can vary a lot by location. Getting answers on the cost of bookkeeping is often less than straightforward. There’s a lot of different information floating around topic no 704 depreciation on cost, and it’s not always clear what might apply to your particular situation. There are also several different ways to approach getting a bookkeeper, which can make it tricky to do apples-to-apples comparison.